What is contents insurance?

Contents insurance protects the items inside your home, such as furniture appliances and valuables, against damage, theft or loss. It does not cover the structure of the home itself.

What it covers and who needs it

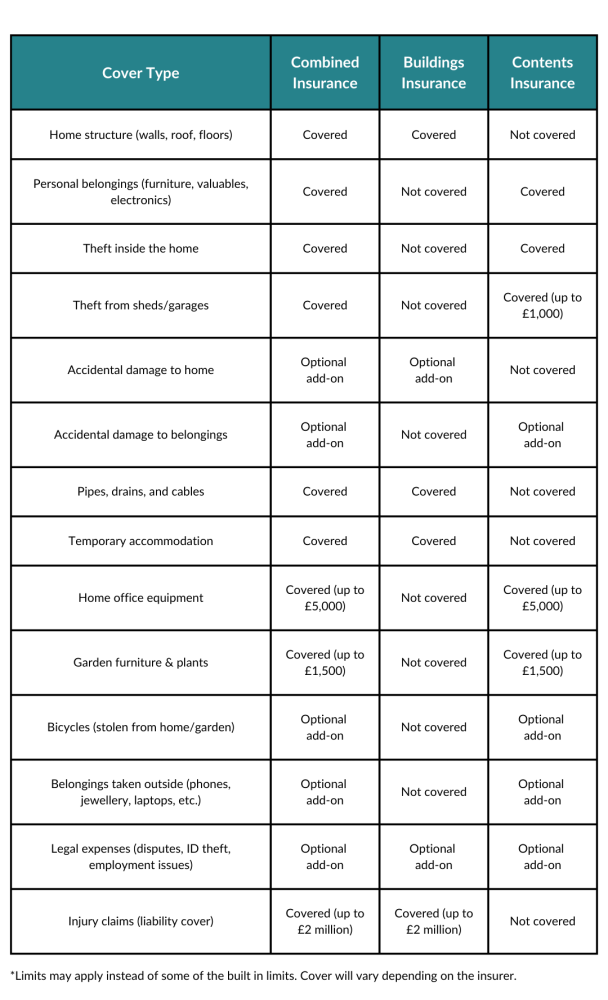

A contents insurance policy includes:

- Furniture, electronics & other insured items: Covers for damage, theft or loss.

- Valuables: There’s normally a maximum claim amount.

- Optional extras: Add-ons like accidental damage and personal possessions cover.

Contents insurance is popular for those who rent their home who have valuable possessions which they’d like to protect. Homeowners also take out contents insurance to cover furniture, electronics and other valuables from risks.

What is buildings insurance?

Buildings insurance protects the physical structure of your home. If the building is damaged by fire, flooding, storms or other insured risks, the policy covers the cost of repairs or rebuilding the home.

What it covers and who needs it

A standard building insurance policy includes:

- Structural cover: Covers walls, roof, floors and permanent fixtures.

- Underground services: Covers accidental damage to pipes, drains and cables.

- Alternative accommodation: Covers temporary housing if the home is uninhabitable.

Optional extras, such as accidental damage cover, can provide additional protection against unexpected damage, such as drilling into a pipe or damaging flooring during renovations.

If you own a property, building insurance is essential. Whether you live in the home or rent it out to a tenant, it protects you from costly repairs. Mortgage lenders also require building insurance as part of their loan agreements.

What is combined home insurance?

Combined home insurance is a policy that protects both the structure of your home and the contents within it. Most policies combine buildings and contents insurance, providing full protection in one package where you know you’re fully covered.

What it covers and who needs it

A home and contents insurance policy typically includes:

- Buildings cover: Protects the structure of your home, including walls, roof and fitted fixtures.

- Contents cover: Covers furniture, electronics, valuables and personal belongings inside the home.

- Liability protection: Provides cover if someone is injured in your home (up to £2 million with us).

Optional extras like accidental damage cover, home emergency cover and legal expenses protection can also be added for broader coverage. If your home becomes uninhabitable due to an insured event, alternative accommodation may also be covered.

Homeowners who live in their property benefit most from home and contents insurance, as it protects both the building and the contents inside.

Tenants don’t need buildings insurance, but they may need contents insurance to cover their own personal belongings.