Do price comparison websites really give you the best cover for your money?

We’re all looking to make the best use of our time with our busy schedules and fast-paced lifestyles, and as the saying goes “work smarter, not harder”. But there are some tasks there’s no escaping from – and choosing the right insurance is one of them.

As human beings, we want things to be simplified, and this is where price comparison websites suck you in. They make us feel as though we are saving time, money, and effort. But…are they really?

We’re sorry to tell you, but car insurance comparison sites aren’t all that they’re made out to be. In this blog, we’re going to show you exactly how by using a comparison site you will likely be getting less cover with a ‘one size fits all’ approach, not always for the most competitive price and spending a lot of time shopping around for the ‘best’ option.

Jump to:

- Comparison sites don’t always give you the cheapest car insurance

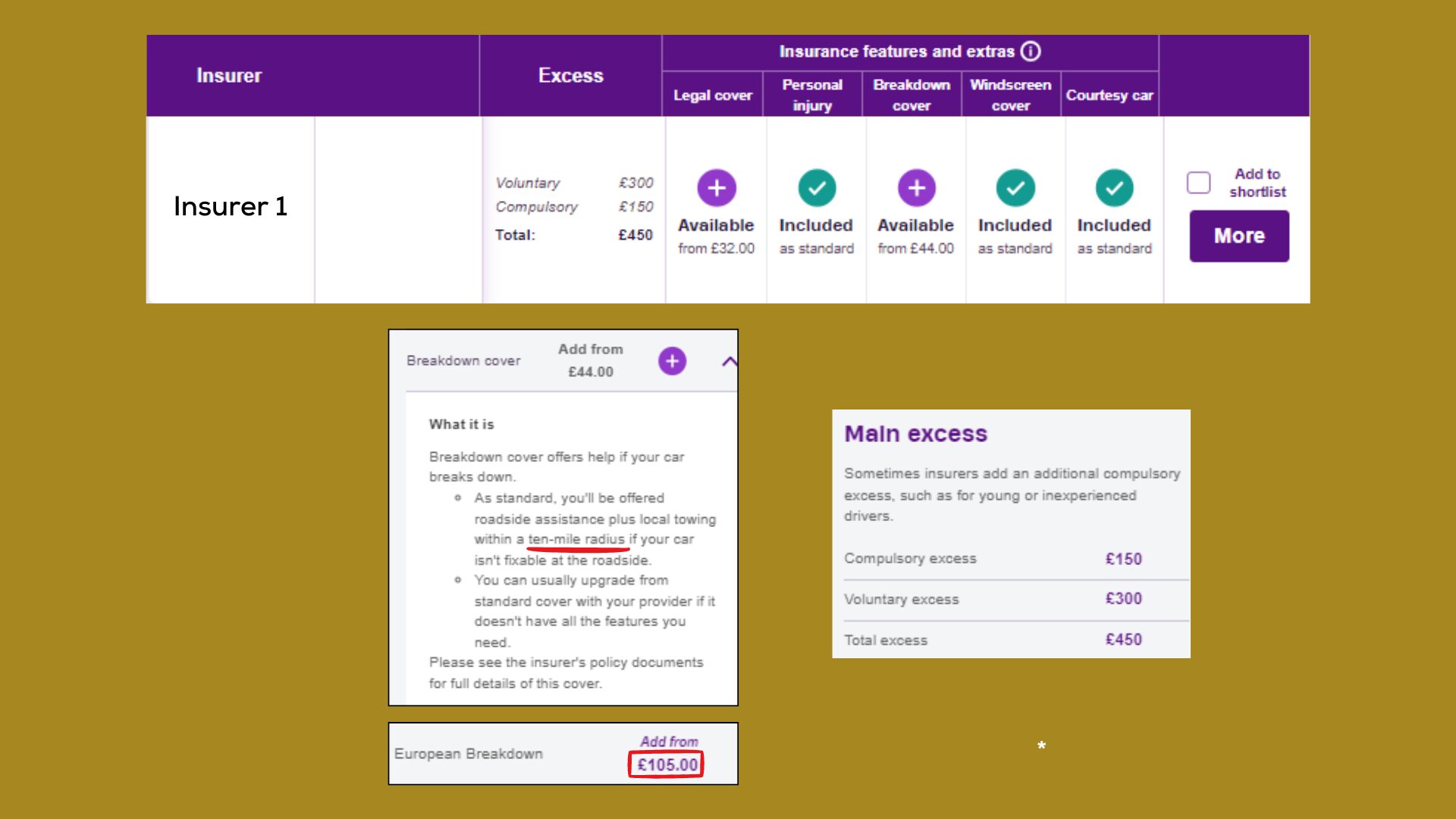

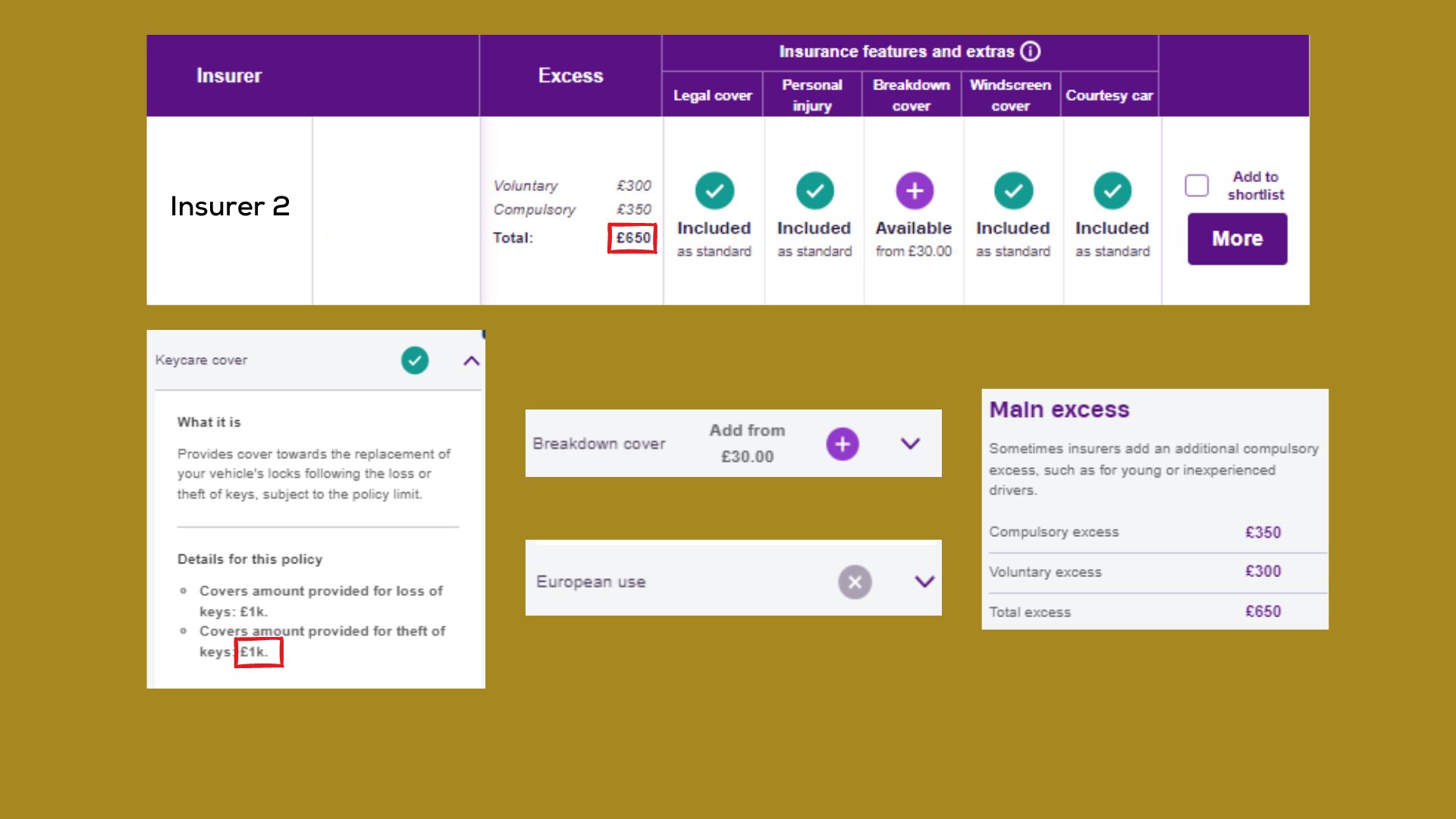

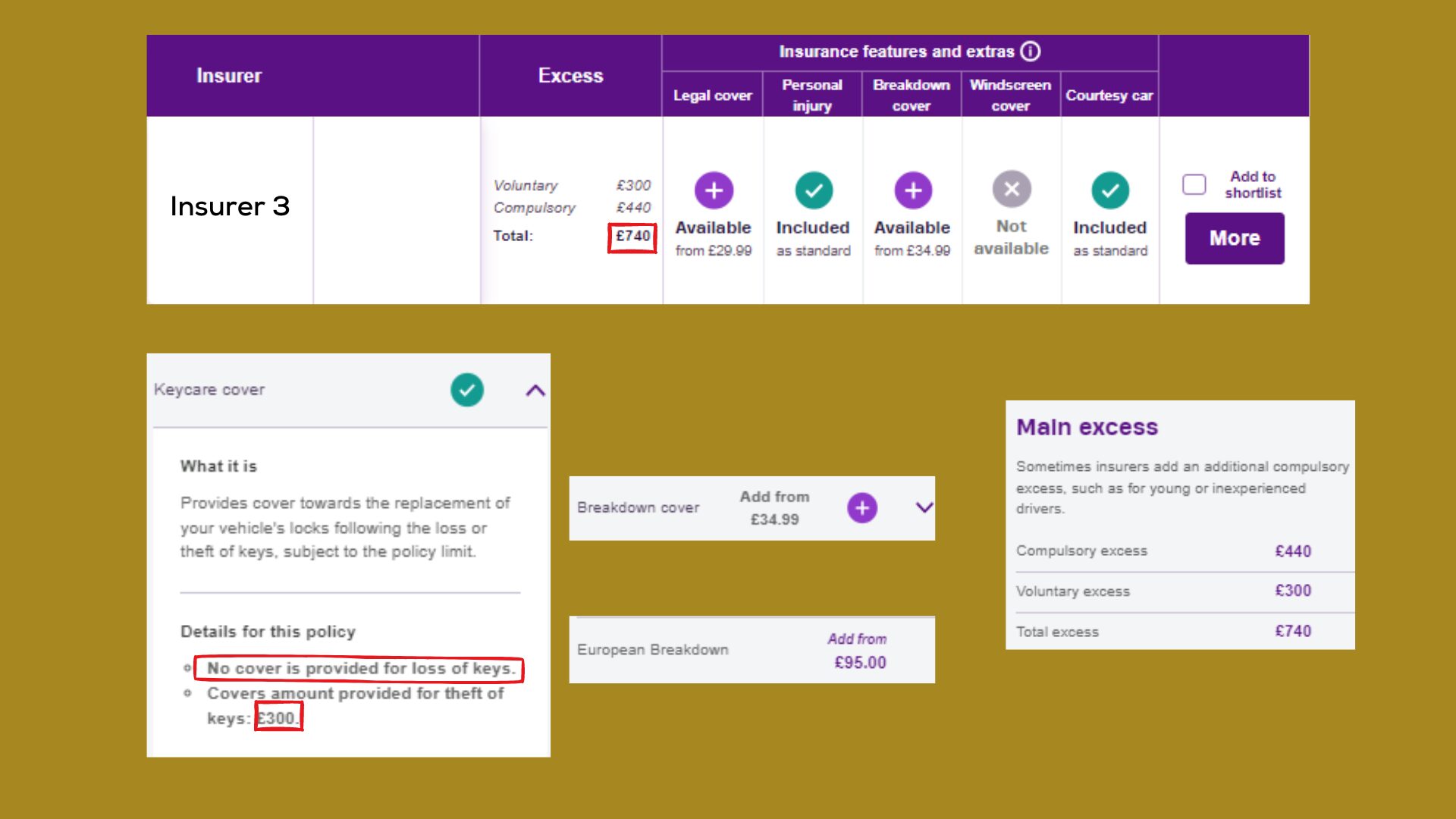

- You may be left with gaps in your cover

- You could spend hours shopping around with no human interaction

- The use of your data

Comparison sites don’t always give you the cheapest car insurance

More often than not: cheaper premium, cheaper product.

One of the most popular reasons why people use comparison sites is to get ‘cheaper insurance.’ Credit where credit is due, comparison sites are what they say on the tin, they enable you to compare prices very easily. In most cases, you can sort the results by price, so finding the cheapest quote available on these sites can be easy for people who like doing to do it this way.

This may lead you to believe that you’re getting the best deal available – after all, all your options are presented to you so clearly on their website…

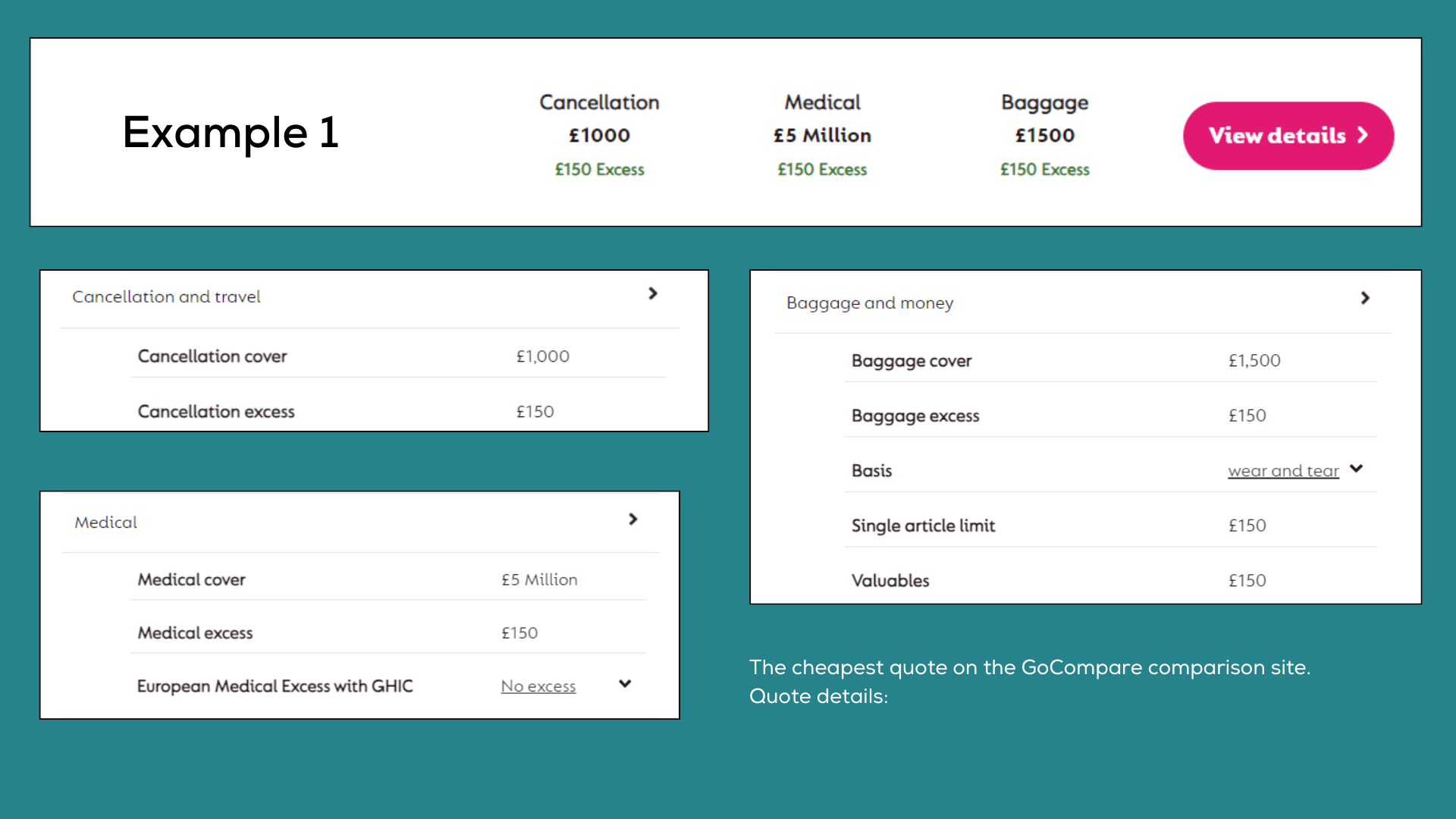

The important part to remember here is that the cheapest quote does not mean it’s the one most suitable for your individual needs to fully cover you. Often with insurance – and other things too – you get what you pay for. So, the cheapest quote will likely give you less cover than you actually need.

For example, some of the cheapest quotes on the car comparison sites will exclude European use, but with us you can expect 90 days European cover as standard.

Are you aware that not all insurers will appear on these sites too? Insurance companies pay the comparison sites to appear in the listings, and even more will likely be paid for the sponsored listings that appear at the top.

There are insurance companies out there – like many that we partner with – who don’t pay the fees to feature on these comparison sites, and the premiums can still work out to be just as competitive…but with additional cover!

Speaking of which, let’s explore what the level of cover is like on comparison sites.